Break-Even Point Formula & Analysis for Your Business

A business may have a high volume of sales, but that doesn’t mean it’s profitable. The break-even point is the point at which total costs are the same as total revenue. « When will we actually make money? » is the burning question for new businesses. Fortunately, you can answer this question by calculating your break-even point. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. A break-even analysis allows you to determine your break-even point.

Who Calculates BEPs?

Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. Another limitation is that the breakeven point assumes that sales prices, variable costs per unit, and total fixed costs remain constant, which is often not the case. The price of goods sold at fluctuates, and the cost of raw materials may hardly stay stable.

- Otherwise, the business will need to wind-down since the current business model is not sustainable.

- A prime location may have higher fixed costs but can lead to increased sales, potentially lowering the break-even point.

- If the stock is trading at a market price of $170, for example, the trader has a profit of $6 (breakeven of $176 minus the current market price of $170).

- Conversely, it can also help you determine how many costs you need to cut to reach profitability.

- In this case, you estimate how many units you need to sell, before you can start having actual profit.

Business Breakeven Points

Let us go through a break-even analysis step by step to illustrate its usefulness with a real-life example of starting a business. So to break even, Maria needs to create and sell eight quilts a month. If she wants to turn a profit, she’ll need to sell at least nine quilts a month.

Introducing a new product or service

The break-even point is crucial for businesses to ensure that they are not operating at a loss. It helps you understand how much money you need to make before you start generating profits, allowing for more effective financial planning. Break-even analysis can help determine those answers before you make any big decisions.

How much are you saving for retirement each month?

To do this, calculate the contribution margin, which is the sale price of the product less variable costs. Your store sells various products, and the average selling price per unit is $5. The variable cost per unit, which includes the cost of goods sold, packaging, and other variable expenses, is $3.

For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all. Finding your break-even point gives you a better idea of which risks are really worth taking. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure. Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500.

But if you sell less, your sales revenue won’t cover your expenses and you’ll operate at a loss. As with most business calculations, it’s quite common that different people have different needs. For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation. A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level.

Some common examples of fixed costs include rent, insurance premiums, and salaries. You can see that all of these costs do not change even if you increase production or make more sales in a particular month. In this case, you estimate how many units you edsel dope need to sell, before you can start having actual profit. The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit. To find your variable costs per unit, start by finding your total cost of goods sold in a month.

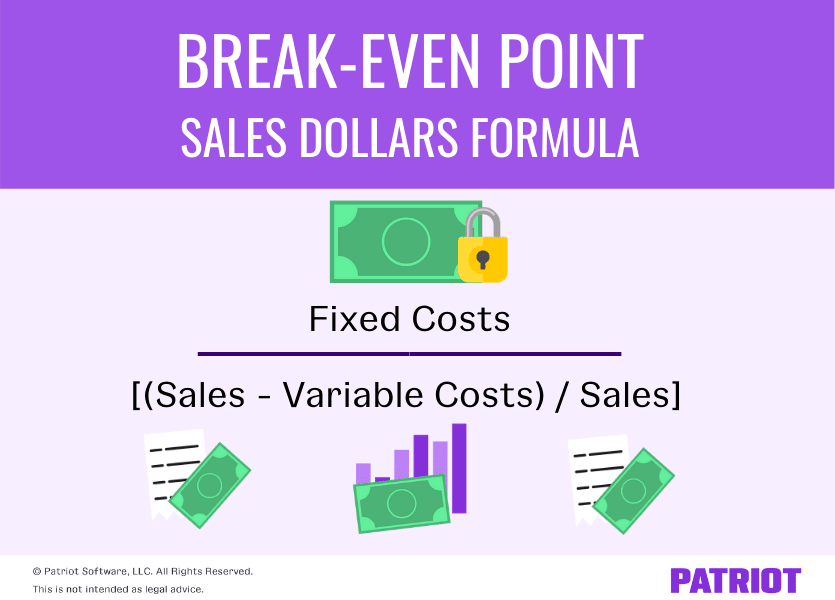

The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit. So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. Calculating the breakeven point is a key financial analysis tool used by business owners. Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point.