Current Ratio Explained With Formula and Examples

« A good current ratio is really determined by industry type, but in most cases, a current ratio between 1.5 and 3 is acceptable, » says Ben Richmond, US country manager at Xero. This means that the value of a company’s assets is 1.5 to 3 times the amount of its current liabilities. The current ratio is a fundamental financial metric that provides valuable insights into a company’s short-term financial health. Imagine it as a financial health checkup for a business, telling us whether it’s equipped to handle its immediate financial responsibilities or if it might be struggling to meet its short-term obligations. By dividing the current assets balance of the company by the current liabilities balance in the coinciding period, we can determine the current ratio for each year.

Book a demo with our friendly team of experts

However, an investor should also take note of a company’s operating cash flow in order to get a better sense of its liquidity. A low current ratio can often be supported by a strong operating cash flow. Potential investors leveraging the current ratio should keep in mind that the assets of companies can vary quite a bit, and businesses with significantly different asset compositions can end up with the same current ratio. However, if you look at company B now, it has all cash in its current assets. Therefore, even though its ratio is 1.45x, strictly from the short-term debt repayment perspective, it is best placed as it can immediately pay off its short-term debt. In many cases, lenders prefer high current ratios, since it indicates that the company won’t have any issues paying the creditor back, while investors may take a high current ratio as a signal of operational inefficiencies.

Formula in the ReadyRatios Analysis Software

- While a high Current Ratio is generally positive, an excessively high ratio may indicate underutilized assets.

- The current assets are cash or assets that are expected to turn into cash within the current year.

- Note the growing A/R balance and inventory balance require further diligence, as the A/R growth could be from the inability to collect cash payments from credit sales.

- A large retailer like Walmart may negotiate favorable terms with suppliers that allow it to keep inventory for longer periods and have generous payment terms or liabilities.

- A more conservative measure of liquidity is the quick ratio — also known as the acid-test ratio — which compares cash and cash equivalents only, to current liabilities.

- However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency.

The study then concludes that the liquidity-profitability tradeoff does exist in the Saudi stock market, and that the effect of the other variables is significant in determining the relationship. This study provides important insight into the effects of liquidity and profitability in an emerging market and the effect of other variables on the relationship between the two. If the current ratio is too high (much more than 2), then the company may not be using its current assets or its short-term financing facilities efficiently. Low values for the current ratio (values less than 1) indicate that a firm may have difficulty meeting current obligations.

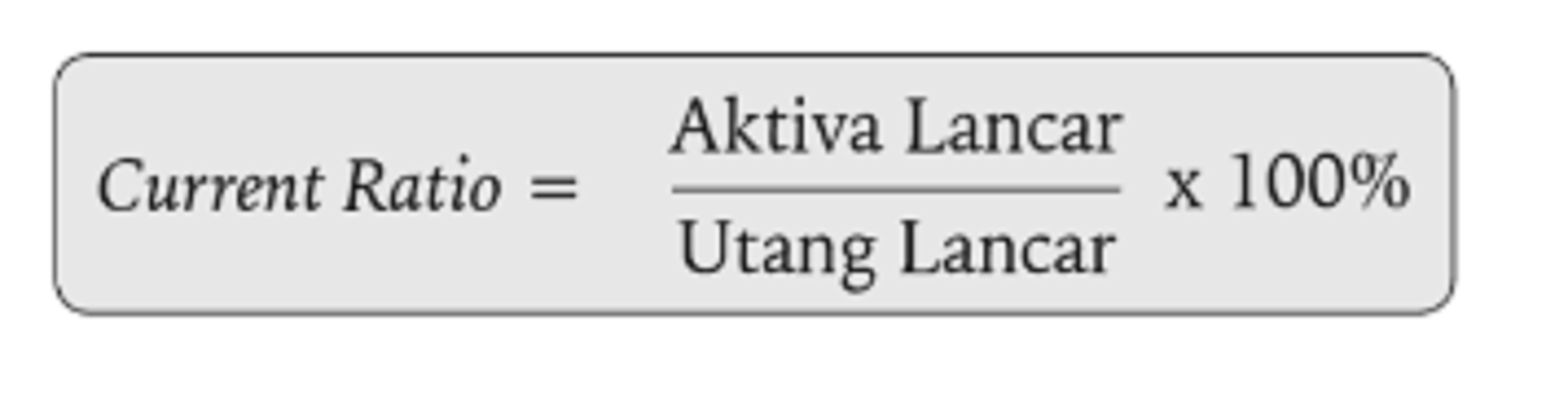

How to calculate the current ratio

A current ratio that is in line with the industry average or slightly higher is generally considered acceptable. A current ratio that is lower than the industry average may indicate a higher risk of distress or default by the company. If a company has a very high current ratio compared with its peer group, it indicates that management may not be using its assets efficiently. The liquidity-profitability tradeoff has been a long-standing debate in the finance literature. According to AMA Eljelly’s International Journal of Commerce and Management (2004), this study empirically investigates the tradeoff between liquidity and profitability in an emerging market. The study focuses on the relationship between liquidity and profitability, taking into account the effect of other variables.

In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Less than 1 means the company has some problems with liquidity, and it may not be able to pay its bills. More than 1 means it’s got more assets than it needs, which is fantastic news — to a point. There are a lot of different ways to evaluate a company’s liquidity, but the current ratio is one that can help you judge just how serious liquidity issues are.

Current Ratio Vs Quick Ratio

From the above table, it is pretty clear that company C has $2.22 of Current Assets for each $1.0 of its liabilities. Company C is more liquid and is better positioned to pay off its liabilities. If you want to get paid faster, you need to understand accounts receivable. As a general rule of thumb, a current ratio in the range of 1.5 what is the extended accounting equation to 3.0 is considered healthy. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. For example, supplier agreements can make a difference to the number of liabilities and assets.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. The current ratio can be expressed in any of the following three ways, but the most popular approach is to express it as a number. Hence, Company Y’s ability to meet its current obligations can in no way be considered worse than X’s. This is once again in line with the current ratio from 2021, indicating that the lower ratio of 2022 was a short-term phenomenon.

Companies that are seasonal or have seasonal cycles in either product production or accounts receivable can look very poor when it comes to the current ratio at certain times of the year and very good at others. However, if you look at several years’ worth of quarterly current ratios, it’s easier to see a pattern emerge. A very high current ratio could mean that a company has substantial assets to cover its liabilities.